As the world becomes increasingly focused on sustainable development and ethical practices, Environmental, Social, and Governance (ESG) criteria have gained significant attention across various industries.

Among these, real estate investing is a sector that has experienced a profound shift. Investors are now factoring in sustainability data like LEED certification when evaluating potential real estate opportunities. This shift is driven by the demand for transparency, sustainability, and long-term profitability in properties.

Let’s explore why sustainability data impacts real estate investing matters for modern investors and how you can leverage sustainability insights to make more informed investment decisions.

Table of Contents

- What is sustainability Data?

- The Importance of sustainability in Real Estate Investing

- How Environmental Factors Influence Real Estate

- Social Considerations in Property Investments

- The Role of Governance in Real Estate Decisions

- Sustainability Reporting and Compliance for Real Estate Investors

- Benefits of Sustainability Integration in Real Estate Portfolios

- How Sustainability data affects real estate investing

What is Sustainability Data?

Sustainability data refers to the metrics and insights related to the environmental, social, and governance practices of a company or asset. For real estate investors, an example of this would be LEED certified buildings. This data helps measure how sustainable and ethical a property investment is.

By analyzing sustainability data using a platform like FolioProjects, investors can assess the risks and opportunities tied to climate, community impact, and corporate governance practices in their real estate portfolios. They can see the performance of existing efforts as well planned endeavors, providing a comprehensive forecast for a real estate portfolio.

The Importance of Sustainability in Real Estate Investing

As the global focus shifts towards sustainability and ethical business practices, sustainability data has become a critical tool for assessing the long-term viability of real estate investments. Incorporating sustainability criteria is essential for identifying not only the environmental impacts of a property but also its social and governance-related performance. Investors who fail to consider sustainability factors risk missing out on key opportunities and facing potential financial, legal, or reputational consequences.

Changing Investor Expectations

Institutional investors, including pension funds, sovereign wealth funds, and REITs (Real Estate Investment Trusts), are increasingly integrating sustainability data into their investment strategies. These large-scale investors demand transparency in how companies approach sustainability, social responsibility, and governance.

Many institutional investors have committed to net-zero carbon goals and now prioritize investments that meet green building standards, offer energy efficiency, and contribute to community well-being. Failing to align with these expectations can limit access to capital.

Sustainability as a Risk Mitigation Tool

Incorporating sustainability criteria into real estate investments serves as an effective risk mitigation strategy. Properties that fail to comply with environmental regulations or fall short in areas like building safety or tenant welfare are exposed to financial and reputational risks.

These risks can come from regulatory fines, lawsuits, or even poor public perception. For example, buildings that do not adhere to the latest sustainability guidelines or fail to address energy consumption could face penalties or decreased demand.

By considering climate-related risks, such as flooding, wildfires, or rising sea levels, investors can protect their portfolios from unforeseen losses. Integrating climate resilience into real estate projects not only reduces risk but can also lead to premium pricing and increased interest from tenants and buyers.

Regulatory Landscape and Compliance

Governments across the globe are tightening regulations surrounding real estate sustainability and governance. For example, the European Union’s Green Deal and Sustainable Finance Disclosure Regulation (SFDR) require that investors disclose how they integrate sustainability into their investment processes.

Similarly, in regions like North America and Asia-Pacific, new carbon emission limits and energy performance standards for buildings are being implemented, pushing investors to prioritize sustainability-compliant assets.

Moreover, local governments are introducing stricter zoning and building codes that prioritize green spaces, energy efficiency, and community benefits. Properties that fail to comply with these evolving regulations could face penalties, difficulty in obtaining permits, or even becoming obsolete. By investing in sustainability-compliant properties, investors can avoid potential legal complications and ensure their assets are aligned with future legislative trends.

Competitive Advantage in Real Estate Markets

Sustainability integration also offers a significant competitive advantage. Properties with strong sustainability credentials—such as green certifications, low energy consumption, and ethical management practices—tend to attract more tenants and buyers.

These properties often command higher rents, maintain higher occupancy rates, and retain value over time. As more businesses and individuals seek sustainable living and working environments, sustainability-compliant real estate assets become more attractive investments.

Additionally, tenants and occupiers are increasingly aware of sustainability and ethical practices. Companies leasing office spaces often prefer buildings that reflect their commitment to corporate social responsibility (CSR). By aligning real estate investments with sustainability principles, investors can target these tenants and demand higher leasing rates.

Increased Financial Performance

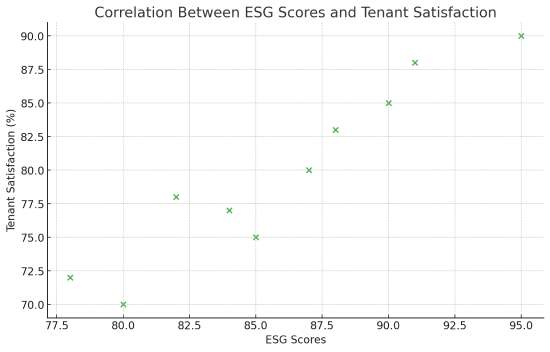

There is growing evidence that real estate investments that meet ESG standards outperform traditional investments. For instance, properties with energy-efficient systems and sustainable building designs generally have lower operational costs, including reduced utility bills and maintenance costs.

Furthermore, properties that contribute positively to the environment or community are likely to appreciate more over time, leading to higher returns on investment.

Many studies have also shown that green buildings experience faster leasing rates and tend to have lower vacancy rates compared to non-sustainable properties. These factors contribute to more stable and predictable cash flows for investors.

Sustainability and Property Valuation

The real estate industry is seeing a shift in how properties are valued. Sustainable properties are increasingly being viewed as premium assets due to their long-term economic, environmental, and social benefits. Green-certified buildings, for example, often command higher valuations due to their lower energy costs, future-proofed compliance, and tenant appeal.

Investors who integrate sustainability considerations into their real estate portfolios may benefit from these trends and capture enhanced value appreciation.

Ultimately, sustainability in real estate investing is no longer just a trend—it’s a critical component of long-term strategy. As demand for sustainable, ethical, and governance-driven assets continues to rise, investors who adapt to these principles will be positioned to thrive in a competitive and increasingly regulated market.

How Environmental Factors Influence Real Estate

The environmental aspect of sustainability is arguably the most impactful in real estate investing. Investors must consider factors such as energy efficiency, carbon footprint, and sustainable construction practices when evaluating properties. Properties that are aligned with environmental standards, such as LEED certification or energy-efficient systems, tend to have lower operational costs and higher demand among tenants.

Climate change is also a key consideration. Investors are increasingly examining properties in areas prone to environmental risks like flooding, wildfires, and sea-level rise. Integrating environmental risk management into real estate strategies helps investors safeguard their portfolios against unforeseen environmental events.

Social Considerations in Property Investments

The social factors in sustainability reflect the broader societal impact of real estate developments. This can include the well-being of tenants, the impact on local communities, and the overall social equity of a property. Investors are paying closer attention to issues like affordable housing, community engagement, and tenant health and safety.

Properties that align with social goals, such as contributing to urban revitalization or improving access to green spaces, are more attractive to investors seeking long-term value. Moreover, socially responsible investments can lead to higher tenant satisfaction, lower vacancy rates, and a better public image for the real estate firm.

The Role of Governance in Real Estate Decisions

Governance is often overlooked in real estate but is crucial for ensuring ethical business practices and sound decision-making. Good governance involves the transparency of property management, fair rental policies, and compliance with local regulations. Strong governance practices can protect investors from legal risks and ensure the long-term sustainability of their investments.

Governance factors also include the diversity of leadership and the implementation of anti-corruption measures. Real estate companies with robust governance structures are more likely to attract institutional investors and deliver consistent returns over time.

Sustainability Reporting and Compliance for Real Estate Investors

Sustainability reporting has become a standard requirement for many real estate companies, particularly those seeking institutional investment. Investors now demand transparency in how companies address environmental, social, and governance issues. Failing to meet sustainability reporting standards can deter potential investors and result in penalties.

Real estate investors should be aware of emerging sustainability regulations, such as the EU Taxonomy and Sustainable Finance Disclosure Regulation (SFDR), which aim to standardize sustainability reporting across sectors. These frameworks help investors compare and assess the sustainability of different real estate assets more effectively.

Benefits of Sustainability Integration in Real Estate Portfolios

Integrating sustainability data into real estate investment strategies offers numerous benefits:

- Risk Mitigation: Properties that meet ESG criteria are less likely to suffer from regulatory penalties, environmental damage, or reputational harm.

- Higher Returns: Sustainable buildings often have higher occupancy rates and lower operational costs, leading to better financial performance.

- Long-Term Value: sustainability-friendly properties tend to retain their value longer, especially in markets where sustainability is prioritized.

- Attraction of Capital: Institutional investors, such as pension funds and endowments, increasingly prioritize sustainability criteria, making sustainability-compliant real estate assets more appealing.

By embracing sustainable investing, real estate investors can not only achieve financial returns but also contribute to the well-being of communities and the environment.

How Sustainability data affects real estate investing

As the real estate industry evolves, the role of sustainability data in shaping investment strategies will only continue to grow. Investors who prioritize sustainable and ethical practices will be well-positioned to navigate future challenges, benefit from emerging regulations, and tap into new market opportunities.

Understanding how sustainability data affects real estate investing is essential for making informed decisions and creating a portfolio that is not only profitable but also resilient in the face of environmental, social, and governance challenges. As the market shifts, staying ahead with sustainability insights will become a critical factor for success in real estate investing.

Tools like FolioProjects are invaluable in helping investors track, manage, and report sustainability data, ensuring that their portfolios remain competitive, sustainable, and aligned with the future of real estate. In an increasingly regulated and environmentally conscious world, having a reliable platform like FolioProjects can make all the difference in the success of real estate investments.

Note that this article is not intended to be investment advice. Consult and authorized financial expert.