British Columbia is entering the most pivotal period for real estate portfolios in over a decade. Construction costs are rising, rezoning expectations are tightening, ESG compliance is becoming structured rather than optional, and stakeholders are demanding measurable engagement rather than promotional messaging.

Organizations that treated property management as an operational task are being forced to shift toward asset lifecycle strategy, where communication, risk, sustainability, stakeholder alignment, and operational data flow together.

This report forecasts the biggest pressures BC portfolio owners, real estate executives, municipalities, and developers will face in 2026. It predicts how lifecycle risk will be measured, how portfolio engagement will impact rezoning outcomes, how sustainability data will affect asset valuation, and how tenant expectations will evolve.

The following insights were prepared specifically for BC-based decision makers seeking lifecycle visibility, stakeholder insight, and strategic resilience across their properties. At Beyond Programs, we specialize in lifecycle property portfolio support.

Table of Contents

- The Emerging Shift in Real Estate Leadership

- Lifecycle Risk Is Becoming Quantifiable

- ESG and Municipal Pressure in 2026

- Community Engagement Will Decide Project Momentum

- Rezoning Complexity and Data Requirements

- Technology Integration: From Software to Strategy

- Tenant Satisfaction as a Value Multiplier

- Portfolio Engagement Dashboards: The New Decision Layer

- 2026 Recommendations for BC Real Estate Leaders

- Preparing a Lifecycle Reporting Strategy

- Final Outlook and Strategic Advantage

The Emerging Shift in Real Estate Leadership

Historically, BC real estate leadership has separated responsibilities across tightly-defined departments. Development teams handled rezoning and feasibility. Operations teams managed leasing and maintenance. Marketing was added when required. ESG reporting was often outsourced.

Today, this fragmented approach is under increasing pressure because councils, investors, boards, and regulators want to see the entire lifecycle of an asset tied to measurable outcomes.

In 2026, the role of the property manager will expand toward portfolio risk steward, while developers will be expected to demonstrate ESG alignment before breaking ground. Roles like Director of Lifecycle Strategy, VP of Real Estate Portfolio Engagement, and Head of ESG and Asset Performance will appear across BC for one key reason: internal silos can no longer keep up with external expectations. This shift will not be optional. It will be demanded by market conditions and legislation.

The next strategic hires in BC real estate will not be tactical operators. They will be lifecycle translators.

Lifecycle Risk Is Becoming Quantifiable

BC municipalities, funding agencies, lenders, and regulators are increasingly asking for evidence-based indicators that measure alignment between assets and their impact on communities. This means risk is no longer descriptive. It is measurable. Each stage of the real estate lifecycle now has specific risk categories associated with it.

| Lifecycle Stage | Emerging Risk Category | What Will Be Measured |

|---|---|---|

| Rezoning | Public alignment risk | Sentiment, objections, feedback volume |

| Construction | Compliance risk | WorkSafeBC, environmental readings |

| Leasing | Reputation risk | Tenant satisfaction, turnover likelihood |

| Occupancy | ESG risk | Energy use, accessibility, sustainability |

| Disposition | Portfolio ROI risk | Lifecycle performance vs projections |

By 2026, BC portfolios will need lifecycle reporting standards similar to financial reporting. The winners will be organizations that treat risk visibility as a competitive advantage rather than a compliance burden.

ESG and Municipal Pressure in 2026

In cities like Victoria, Burnaby, Richmond, and Nanaimo, planning departments are quietly increasing their expectations for documentation during rezoning and redevelopment. ESG concepts are now appearing in municipal planning feedback, even when not explicitly listed in application requirements. This signals a major shift approaching for 2026. Cities will expect applicants to quantify alignment with local sustainability goals, not just state intent.

Two ESG trends are accelerating in BC:

- Regulatory convergence: Federal and provincial agencies are aligning expectations for sustainability disclosure.

- Municipal expectation creep: Cities now expect lifecycle thoughtfulness before they issue approvals.

| ESG Pressure Source | Impact on Real Estate Strategy |

|---|---|

| Federal ESG reporting policy | Pushes investors to demand lifecycle data |

| City planning departments | Request project transparency pre-approval |

| Tenant demand for sustainability | Drives retention and renewal value |

| Corporate governance | Requires defensible data before board signoff |

The portfolios that prepare for ESG expectations early will gain smoother municipal relationships and stronger investor positioning. By 2026, ESG will not be a checkbox. It will be a negotiation tool.

Community Engagement Will Decide Project Momentum

Public engagement is no longer a surface-level tactic. It is rapidly becoming a data layer that municipalities may expect during rezoning reviews and community consultations. Opposition cannot be prevented, but it can be measured, and momentum can be shaped early if stakeholders receive meaningful visibility into project details.

BC organizations that adopt community engagement tools are seeing three major benefits:

- Faster rezoning through clarity and proof of alignment

- Reduced resistance due to transparency

- Better positioning with local media and council staff

Developers using digital tools to capture feedback earlier in their process are discovering that trust builds faster when visuals and location-specific impacts are shown. When allowed to participate meaningfully, communities contribute rather than resist. In 2026, this will become one of the strongest differentiators for rezoning success in British Columbia.

Rezoning Complexity and Data Requirements

Rezoning in 2026 will likely require forms of transparency not widely expected today. Developers may be asked how they tracked public responses, how they processed objections, whether they held local meetings, and if real-time engagement was made possible. This means the rezoning application format will evolve, not just its content.

Three municipalities watching this closely:

- City of Burnaby

- City of Victoria

- City of Surrey

These locations already raise questions about community impact in meetings. The next phase of this evolution is documentation. Rezoning software for land development engagement in BC will become a high demand category. The portfolios that show structured processes, clear intent, and evidence-based alignment with community concerns will likely receive faster approvals.

Rezoning will no longer be purely technical. It is shifting toward stakeholder visibility and lifecycle accountability. This transition will mark one of the largest evolutions in BC property development over the next three years.

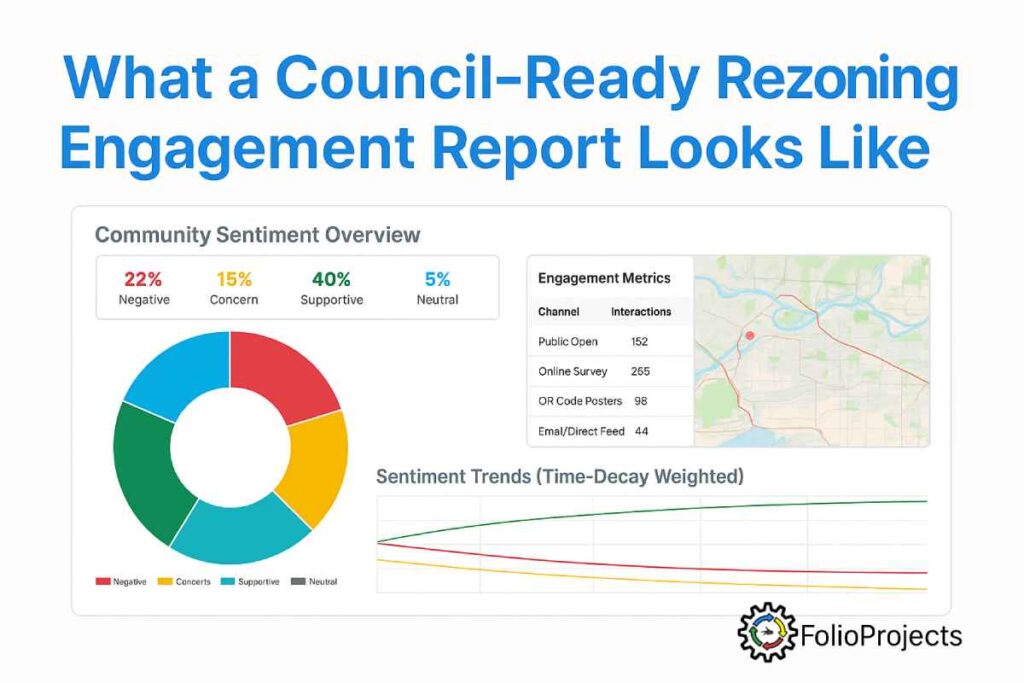

At Beyond Programs, we specialize in de-risking the rezoning process through community engagement. We create a council ready report with ESG, mapping, and time decayed trend lines, so that we convey that the community was actually engaged. We provide insight in the article titled What a Council-ready rezoning engagement report looks like.

Technology Integration: From Software to Strategy

Many real estate companies already use tools for accounting, project management, customer relationship management, and document control. The next phase will require unified portfolio visibility, where stakeholders, ESG metrics, community data, and risk indicators are tied together. The missing piece is integration across lifecycle phases. At Beyond Programs, we specialize in technology integration.

Executives have started asking a new question: Can this tool help us make better strategic decisions?

Technology will shift from operational support to engagement strategy and decision support. Data will come from multiple sources and feed into a portfolio-level intelligence layer. Companies that master this shift will make stronger strategic moves at acquisition, rezoning, preconstruction, and divestment.

Tenant Satisfaction as a Value Multiplier

Tenant experience has always mattered, but it is becoming capitalized. Investors increasingly review tenant feedback when evaluating risk. Municipalities are quietly beginning to track online reviews of rental and commercial assets. This means that tenant satisfaction data will affect reputation, rezoning success, and operational valuation more than ever before.

Several BC property groups are now collecting:

- Renewal probability

- Complaint category trends

- Post occupancy ESG alignment

- Localized amenity requests

- Sentiment trend tracking

The portfolios that connect tenant satisfaction to lifecycle planning will retain value longer and make higher quality decisions. Those that continue to rely on reactive property management alone may struggle to hold value across regulatory cycles and shifting expectations from city officials.

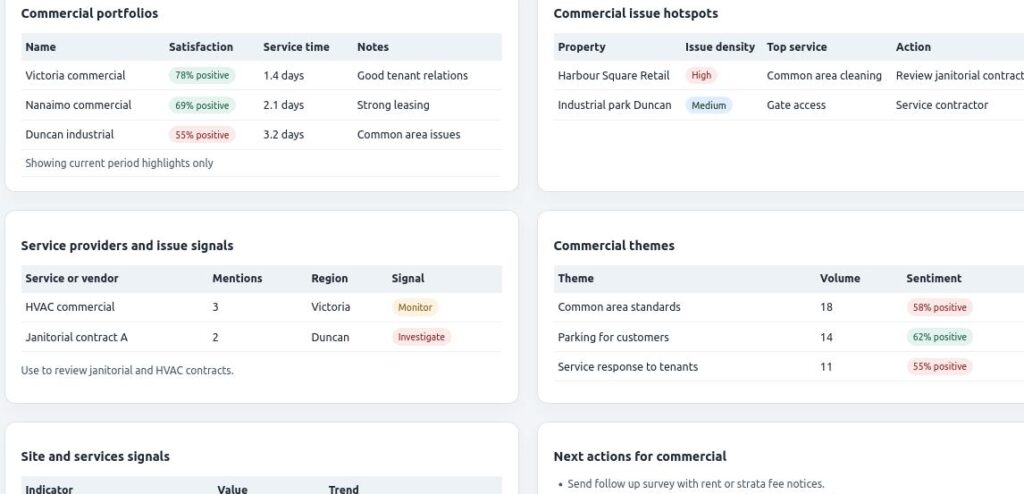

That’s why at Beyond Programs, we own a tenant engagement reporting platform that helps us to understand issues ahead of time like complaint rates, types of complaints, satisfaction, service response rate, etc. We map everything and track trends over time to discover potential issues before they become problems.

Portfolio Engagement Dashboards: The New Decision Layer

A portfolio dashboard is no longer just a project tracker. In 2026, it will be treated as an executive briefing tool. Asset data will be tied to lifecycle indicators such as public sentiment, ESG alignment, rezoning readiness, occupancy health, and risk level. Visual clarity will replace committee speculation.

The dashboard that wins will be one that:

• Shows each asset in real time

• Displays stakeholder sentiment history

• Tracks alerts tied to ESG or compliance

• Communicates risk before crisis emerges

What separated successful BC portfolios in 2025 was their ability to share visibility with decision makers. What will define success in 2026 is the ability to translate that visibility into strategic foresight.

2026 Recommendations for BC Real Estate Leaders

Preparedness is no longer about documentation. It is about clarity, communication, and foresight. The most competitive organizations will adopt a lifecycle mindset and share data with municipalities, boards, investors, and stakeholders as early as possible.

Practical steps for real estate portfolios:

• Begin tracking real-time risk indicators across assets

• Prepare engagement evidence before conflicts emerge

• Generate ESG summaries rather than raw metrics

• Integrate tenant feedback into capital decisions

• Build lifecycle dashboards for board briefing

This groundwork will reduce delays, increase trust, and strengthen asset value over time. BC real estate is becoming more complex, but clarity consistently creates the strongest advantage.

Preparing a Lifecycle Reporting Strategy

Lifecycle reporting is not about building another silo. It is about connecting the ones that already exist. BC owners and operators should build lifecycle workflows that integrate easily into current systems. The process should be incremental and defensible rather than rushed and superficial.

The strongest lifecycle frameworks will include:

• Stakeholder data

• Risk indicators

• ESG tracking

• Tenant sentiment

• Rezoning readiness

• Asset health scores

• Public perception trendlines

Real estate success in 2026 will be determined by how effectively portfolios can communicate confidence before being asked to defend it.

Final Outlook and Strategic Advantage

BC real estate leadership is evolving toward lifecycle accountability. The organizations that adopt portfolio engagement strategies, data-driven foresight, and transparent ESG communication will thrive across planning, development, operations, and disposition. The portfolios that stay reactive will face greater friction, slower approvals, and lower confidence from investors, city planners, tenants, and funding bodies.

The strongest real estate leaders of 2026 will not simply operate properties. They will guide portfolios through change, alignment, clarity, and trusted visibility.